06

Oct

First Real Time International Money Transfer from Bangladesh

Comments

Innovation Name: International Insta Remit

Category: Innovation in Banks

Company: Social Islami Bank Ltd.

The content of this case study was written by the representatives of Western Union Bangladesh.

Background

- Bangladesh intra payment system has grown drastically when transfers are made between Banks, Wallets and Cards real time

- International Remittances to Bangladesh has also evolved with NPSB, BEFTN etc.

- But International Remit from Bangladesh to world is still not developed and Correspondence Banking and Demand Drafts are been used

- Resulted in customer inconvenience, due to high cost, transfer time, uncertainty of fund transfer

- Which piqued customers to look for alternative options like Hundi

- Formal Outbound Market (C2C/C2B): $200 MN, Informal Market: $800 Million

Objective

Address the key customer pain points for International Remit from Bangladesh

- Real Time transfer (Money in Minutes).

- Funds out option – Cash, Bank Account, Mobile Wallet, Cards

- Lower Charges and Transparency

- No corresponding Banking charges

- Settlement in Multiple Currency

- Easy Cancellation

The Idea

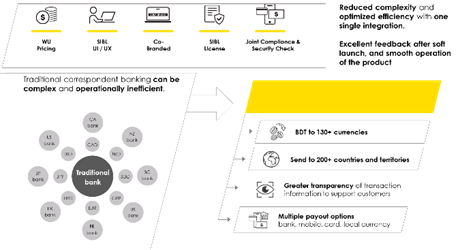

Leverage the capacity of a Global Fintech & Money Transfer Company, with a state of art product development to meet customer & regulatory expectation and mitigate the current customer pain points.

Execution

- Identification of the scope under FED GEFT Guideline of Bangladesh Bank for Realtime C2C / C2B Transfer.

– Student Payment – Insta Edu Remit

– Medical Payment – Insta Medi Remit

– Expatriate Payment – Insta Family Remit

- Regulation change of the Central Bank with special approval to SIBL to execute the service through Western Union.

- Develop a Gateway & Host to Host solution by connecting 200+API of Western Union with SIBL core banking system.

Result